#1: Vrijednost investiranje nije lako

Vrijednost ulaganja zahtijeva mnogo napornog rada, neuobičajeno strogu disciplinu, i dugoročna ulaganja. Malo su voljni i u mogućnosti posvetiti dovoljno vremena i truda da postane value investitorima, i samo dio one imati pravilan mentalni sklop za uspjeh.

Kao većina osmi- razreda iz matematike, Neki investitori zapamtiti nekoliko formula ili pravila i površno se nadležna ali stvarno ne razumijem što oni rade. Ostvariti dugoročni uspjeh mnogih financijsko tržište i ekonomski ciklusi, promatranja na nekoliko pravila nije dovoljno.

Previše stvari previše brzo promijeniti u svijetu investicija za taj pristup za uspjeh. Potrebno je umjesto toga shvatiti razloge iza pravila kako bi cijeniti zašto oni rade kada oni i ne ’ t kad oni ne ’ t. Vrijednost investiranje nije koncept koji može naučiti i primijeniti postupno tijekom vremena. To je bilo apsorbira i usvojen u jednom, ili nikada zaista naučio.

Vrijednost ulaganja je jednostavna za razumjeti, ali teško provoditi. Vrijednost ulagači nisu super-sofisticiranih analitičkih čarobnjaci koji stvaraju i primjenjuju zapetljan računalne modele pronaći atraktivne mogućnosti ili procijeniti vrijednost podlozi.

Teži dio je disciplina, strpljenje, i presude. Investitora treba disciplina kako bi se izbjeglo mnogo neatraktivan parcele koje su bačena, strpljenja čekati za pravu parcele, i znati kada je vrijeme na ljuljački.

#2: Kao vrijednost investitor

Disciplinirano provođenje Rasprodaje čini vrijednost ulaganja vrlo oprezne pristup. Najveći izazov za value investitorima je održavati potrebnu disciplinu.

Znači biti vrijednost investitor obično stoji gužve, izazivajući konvencionalna mudrost, i suprotstavljene vetar ulaganja. To može biti vrlo osamljen poduzetnika.

Vrijednost investitor svibanj iskustvo siromašnih, Čak i grozan, performanse u odnosu na druge investitore ili tržište u cjelini tijekom duljeg razdoblja tržištu precijenjenost. Ali na dugoročno vrijednost pristup funkcionira tako uspješno da nekoliko, Ako bilo koji, Zagovornici filozofije ikada napustiti.

#3: Investitor je najgori neprijatelj

Ako investitori mogu predvidjeti Budući smjer na tržištu, Svakako ne odluče biti value investitorima. Doista, Kada su porastu cijena vrijednosnica, pristup na vrijednost je obično hendikep; vanjska strana- za uslugu vrijednosnih papira imaju tendenciju da rastu manje od javnosti ’ s favoritima. Kada tržište postaje potpuno vrijednosti na putu da se overvalued, vrijednost ulagači opet slabo zbivati jer oni prodaju prerano.

Najkorisnije vrijeme biti vrijednost investitor je kad tržište pada. To je kad nedostatak rizika važno i kada investitori koji su samo zabrinuti što može ići pravo na posljedice pretjeran optimizam. Vrijednost investitori ulagati marginu sigurnosti koja štiti od velikih gubitaka u padu tržišta.

One koji mogu sudjelovati, u marginu koristeći posudili novac, Kada tržište je ustati i izaći na tržište prije nego što se smanjuje. Nažalost, Mnogi više investitori tvrde sposobnost predvidjeti tržište ’ smjer nego zaista posjeduju tu sposobnost. (Ja sam upoznao nekog.)

Oni od nas koji znaju da mi mogu točno predvidi sigurnost cijene su savjetovani da razmotrite vrijednost ulaganja, sigurna i uspješna strategija u svim investicijskog okruženja.

#4: To je sve o razmišljanje

Ulaganja uspjeh zahtijeva odgovarajuće razmišljanje.

Ulaganje je ozbiljan posao, nije zabava. Ako želite sudjelovati u financijskim tržištima na sve, bitno je da to učinite kao investitor, Ne kao špekulant, i da biste bili sigurni da razumijete razliku.

Nepotrebno je reći, investitori su u mogućnosti razlikovati Pepsico od Picassa i razlika između ulaganja i kolekcionarskih.

Kada svoju teško zarađenu ušteđevinu i buduće financijske sigurnosti su u pitanju, troškovi ne pravi razliku je neprihvatljiv.

#5: Ne traže gospodina. Tržište je savjet

Neki investitori – stvarno špekulanti – pogrešno gledati g. Tržište za ulaganja smjernice.

Promatraju ga postavljanje nižu cijenu vrijednosnice i, neobazriv njegove iracionalnosti, žurbe prodavati njihove imovine, Ignoriranje vlastitih procjena temeljne vrijednosti. Drugi puta vide ga podizanje cijene i, Povjerljiv svoj trag, Kupi u veća brojka kao da je znao više nego što.

Stvarnost je da je g.. Tržište ne zna ništa, se proizvod kolektivne akcije tisuće kupaca i prodavača koji sami nisu uvijek motivirane ulaganja osnove.

Emocionalni investitori i špekulanti neizbježno izgubiti novac; investitori koji iskorištavaju g. Tržište ’ s povremenim iracionalnosti, s druge strane, imaju dobre šanse za uživanje u dugoročni uspjeh.

#6: Dionice Vs biznisa

Louis Lowenstein je upozorio nas razlikovati pravi uspjeh ulaganja s ogledalo uspjeha na tržištu dionica.

Činjenicu da cijena dionica raste ne osigurava temeljni posao dobro ili da rast cijena je opravdano odgovarajuće povećanje temeljne vrijednosti. Isto tako, Cijena pada i sama ne odražava negativne poslovni ili kakvo.

To je od vitalne važnosti za investitore razlikovati fluktuacije cijena dionica od temeljne poslovne stvarnosti. Ako je opća tendencija za kupnju začeti više kupnje i prodaje kako bi došlo više prodaje, investitori moraju boriti sklon popustiti na tržišne uvjete.

Ne možeš ignorirati na tržištu – ignoriranje izvor ulaganja mogućnosti bi očito bilo pogrešno, ali morate misliti svojom glavom i ne dopustiti tržištu da vas.

#7: Cijena Vs vrijednost

Vrijednost u odnosu na cijenu, Ne sama cijena, morate odrediti svoje investicijske odluke.

Ako ste obličje za g. Tržište kao tvorca mogućnosti ulaganja (gdje cijena polazi iz temeljne vrijednosti), Imaš sposobnosti vrijednost investitor.

Ako inzistiraš da gospodin. Tržište za ulaganja smjernice, Međutim, preporuča se najbolje zaposliti nekog drugog da upravljati svojim novcem.

Jer sigurnost cijene možete promijeniti bilo koji broj razloga i jer je nemoguće znati kakva očekivanja odražavaju se u bilo kojem danu razinu Cijena, investitori gledati iza sigurnosti cijene temeljne poslovne vrijednosti, uvijek uspoređuju dva kao dio procesa ulaganja.

#8: Emocije igrati pustoš investiranje

Uspješna investitore dominiraju emocije. Radije nego hladno i racionalno podnosi fluktuacije tržišta, Oni reagiraju emocionalno od pohlepe i straha.

Svi znamo ljude koji djeluju odgovorno i svjesno većinu vremena, ali podivljao kad ulaganje novca. Može proći više mjeseci, Čak i godina, težak rad i discipliniran spremanje akumulirati novac ali samo nekoliko minuta je.

Isti ljudi bi pročitao nekoliko potrošača publikacija i posjetite brojne trgovine prije kupovine stereo ili kamera još potrošiti malo ili nimalo vremena istražuje dionice su samo čuo od prijatelja.

Racionalnost koja se primjenjuje na nabavku elektronske i fotografske opreme je odsutan kada je riječ o ulaganju.

#9: Burza ≠ brzo novac

Mnoge neuspješni investitori na burzi smatraju kako zaraditi bez rada, a ne kao način da ulažu kapital kako bi se zaraditi pristojan povratak.

Svatko će uživati u brzo i jednostavno dobiti, i izgledi za lako dobiti potiče pohlepu u investitorima. Pohlepa vodi mnoge investitore da traže kratice do uspjeha ulaganja.

A ne dopuštajući vraća se spoj na vrijeme, Oni pokušavaju pretvoriti brzu zaradu djelovanjem na seksi Savjeti. Ne zaustavljaju se uzeti u obzir kako tipster bi moglo biti vrijedne informacije koje nije protupravno i zašto, Ako je tako vrijedna, To je bitak je napravio raspoloživ za njih.

Pohlepa također manifestira kao Pretjeran optimizam ili, više suptilno, kao i samozadovoljstvo zbog loših vijesti.

Konačno pohlepa može uzrokovati investitore da preusmjeriti svoj fokus ostvarenje dugoročnih ciljeva ulaganja u korist kratkoročnih spekulacije.

#10: Burza ciklusa

Sve tržištu fads doći kraj. Sigurnost cijene na kraju postane previsoka, stigne i onda premašuje potražnju, na vrhu je postignut, i slijedi silazni slajd.

Uvijek će biti ciklusa ulaganja mode i kao sigurno investitora koji su osjetljivi na njih.

Pošteno je napomenuti da to nije jednostavno razlikovati ulaganja hir pravi poslovni trend. Doista, mnoge investicije fads nastaju u pravi poslovni trendovi, koji zaslužuju da se odraziti na cijene dionica.

Hir postaje opasno, Međutim, kada cijene dionica do razina koje nisu podržane u konzervativno procijenjene vrijednosti predmetnog poduzeća.

#11: Koliko velike investitore ludovati i zašto su neki daju loše rezultate

Ako ponašanje institucionalni investitori bili nitko ’ t užasavajuće, Trebalo bi biti smiješni.

Stotine milijardi drugih ljudi ’ s teško zarađen dolara su rutinski tučeno iz investicijskih ulaganja temelji se na malo ili nimalo in-dubina istraživanja ili analiza.

Prevladavajući mentalitet je konsenzus, groupthink. Uz mnoštvo osigurava prihvatljivo prosječnost;

djelujući samostalno pokreće rizik neprihvatljiv slabijih.

Doista, kratkom roku, Relativna učinkovitost orijentaciju mnogo novac menadžeri je napravio “institucionalne investitore” u suprotnosti.

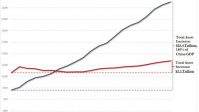

Najviše novca menadžerima se nadoknađuje, ne pokazuju rezultati postižu, Ali u postotku od ukupne imovine pod upravljanjem. Poticaj je za proširenje upravlja imovinom kako bi se generirati dodatne naknade. Ipak, dok posao novac uprava obično postaje profitabilniji kao imovina pod upravljanje povećanje, dobra investicija izvedbe postaje sve teže.

Ovaj sukob između najboljem interesu upravitelja novac i da klijenti obično rješavaju u upravitelju ’ s uslugu.

#12: Kratkoročne, Derbi s relativnim performansama

Kao psi koji jure svoje repove, institucionalnih ulagača postali su zaključani u kratkoročni, Relativna- izvođenje derbi. Upravitelji fondova u jednoj instituciji pretrpjeli su ometanje izračuna uspješnosti po satu; brojni menadžeri pružaju svakodnevne usporedbe svojih rezultata s rezultatima upravitelja u drugim poduzećima.

Česti usporedni rang može samo ojačati kratkoročnu perspektivu ulaganja.

Razumljivo je da je teško održati dugoročno stajalište, suočeni s kaznama za kratkoročne lošije, dugo- dugoročne možda od nezaposlenih.

Ulaganje bez razumijevanja ponašanja institucionalnih investitora je poput vožnje u stranoj zemlji bez karte. Možda ćete na kraju dobiti gdje ćete, Ali putovanje će sigurno trajati dulje, i rizik uzimajući izgubljen

na putu.

#13: Prvi, na putu

Warren Buffett voli reći da je prvo pravilo ulaganja “Nemoj izgubiti novac.,” a drugo pravilo je, “Nikad ne zaboravi prvo pravilo.”

I ja vjerujem da izbjegavanje gubitka bi trebao biti primarni cilj svakog investitora. To ne znači da ulagatelji nikada ne bi smjeli snositi rizik od bilo kakvog gubitka na svim. Radije “ne izgubiti novac” znači da se tijekom nekoliko godina investicijski portfelj ne bi trebao izlagati znatnom gubitku glavnice.

Iako nitko ne želi snositi gubitke, Niste to mogli dokazati iz ispitivanja ponašanja većine investitora i špekulanti. Spekulativna nagon koji leži u većini nas je jak; mogućnost besplatnog ručka može biti uvjerljiva, posebno kada su drugi već naizgled sudjelovali.

To može biti teško koncentrirati na potencijalne gubitke, dok su drugi pohlepno posezanje za dobitke i vaš broker je na telefon nudi dionice u najnovije “Vanjska” početne javne ponude. Ipak, izbjegavanje gubitka najsigurniji je način osiguravanja profitabilnog ishoda.

#14: Relevantnost privremenih fluktuacija cijena

Osim vjerojatnosti trajnog gubitka povezanog s investicijskim, postoji i mogućnost privremenih fluktuacija cijena koje nisu povezane s odnosnim.

Mnogi ulagači smatraju da su fluktuacije cijena značajan rizik: ako je cijena ide dolje, ulaganja smatraju se rizičnima bez obzira na osnove.

Ali su privremene fluktuacije cijena stvarno rizik? Ne na način na koji su trajna umanjenja vrijednosti, a zatim samo za određene ulagatelje u posebnim.

Tako je, naravno, nije uvijek lako za investitore razlikovati privremene nestabilnosti cijena, kratkoročnim silama ponude i potražnje, kretanja cijena koja se odnose na poslovne osnove. Stvarnost može postati očigledna tek nakon činjenice da.

Iako bi ulagači trebali očito pokušati izbjeći preplaćivanje ulaganja ili kupnju u poduzećima koja naknadno smanjuju vrijednost zbog pogoršanja rezultata, nije moguće izbjeći nasumičnu kratkoročnu nestabilnost tržišta. Doista, ulagači bi trebali očekivati da će se cijene mijenjati i ne bi trebali ulagati u vrijednosne papire ako ne mogu tolerirati.

Ako kupujete zvučnu vrijednost uz popust, kratkoročne fluktuacije cijena bitne? Na duge staze oni ne smeta puno; vrijednost u konačnici će se odraziti na cijenu vrijednosnog papira. Doista, Ironično, dugoročna implikacija ulaganja fluktuacija cijena u suprotnom smjeru od kratkoročnog tržišnog učinka.

Primjerice,, kratkoročni pad cijena zapravo povećava prinose dugoročnih ulagača. Postoje, Međutim, nekoliko mogućnosti u kojima kratkoročne fluktuacije cijena ne smetaju ulagačima. Nositelji osiguranja koji trebaju prodati u žurbi su na milost i nemilost tržišnih cijena. Trik uspješnih investitora je prodati kada žele, ne kada moraju.

Kratkoročne sigurnosne cijene važne su i ulagačima u problematičnu tvrtku. Ako poduzeće mora prikupiti dodatni kapital u kratkom roku kako bi preživio, ulagateljima u vrijednosne papire može se utvrditi njihova sudbina, barem djelomično, prevladavajućom tržišnom cijenom dionica i obveznica društva.

Treći razlog zbog kojeg su dugoročni ulagači zainteresirani za kratkoročne fluktuacije cijena jest da. Tržište može stvoriti vrlo atraktivne mogućnosti za kupnju i prodaju. Ako imate gotovinu, možete iskoristiti takve mogućnosti. Ako ste u potpunosti uloženi kada tržište opada, vaš portfelj će vjerojatno pasti u vrijednosti, lišenje prednosti koje proizlaze iz mogućnosti kupnje na nižim razinama. Time se stvara trošak prilike, potrebu za odreći se budućih prilika koje nastaju. Ako je ono što držite nepromjenjivo ili neutrživo, troškova prilika dodatno se povećava; nelikvidnost isključuje vaš prelazak na bolje rasprodaje.

#15: Razumne & Dosljedna povrati > Spectacular & Hlapljivi povrati

Posljedica važnosti složenosti je da je vrlo teško oporaviti se od čak i jednog velikog gubitka, koji bi doslovno mogao uništiti sve odjednom blagotvorne učinke višegodišnjeg uspjeha ulaganja.

Drugim riječima, investitor je više vjerojatno da će učiniti dobro postizanjem dosljedno dobar vraća s ograničenim downside rizik nego postizanje mlaćenje, a ponekad čak i spektakularne dobitke, ali sa znatnim rizikom od glavnice.

Investitor koji zarađuje 16 godišnjih prinosa tijekom desetljeća, na primjer,, Će, možda iznenađujuće, završiti s više novca nego investitor koji zarađuje 20 posto godišnje za devet godina, a zatim gubi 15 posto desete godine.

#16: Pripremite se za najgore

Namjera investitora da izbjegne gubitak mora se pozicionirati kako bi preživjeli, pa čak i napredovati ni pod kojim okolnostima.

Loša sreća te može zadesiti.; pogreške dogoditi.

... razborito, dalekovidnog ulagača upravlja svojim portfeljem sa znanjem da se financijske katastrofe mogu i dogode. Investors must be willing to forego some near-term return, if necessary, as an insurance premium against unexpected and unpredictable adversity.

#17: Focus on Process, Not the Outcome

Many investors mistakenly establish an investment goal of achieving a specific rate of return. Setting a goal, unfortunately, does not make that return achievable. Doista, no matter what the goal, it may be out of reach.

Stating that you want to earn, say, 15 percent a year, does not tell you a thing about how to achieve it. Investment returns are not a direct function of how long or hard you work or how much you wish to earn. A ditch digger can work an hour of overtime for extra pay, and a piece worker earns more the more he or she produces. An investor cannot decide to think harder or put in overtime in order to achieve a higher return.

All an investor can do is follow a consistently disciplined and rigorous approach; over time the returns will come. Rather than targeting a desired rate of return, even an eminently reasonable one, investors should target risk.

#18: Wait for the Right Pitch

Warren Buffett uses a baseball analogy to articulate the discipline of value investors. A long-term-oriented value investor is a batter in a game where no balls or strikes are called, allowing dozens, even hundreds, of pitches to go by, including many at which other batters would swing.

Value investors are students of the game; they learn from every pitch, those at which they swing and those they let pass by. Na njih ne utječe način na koji drugi obavljaju; motivirani su samo vlastitim rezultatima. Oni imaju beskrajno strpljenje i spremni su čekati dok ih ne bace, a oni mogu nositi-undervalued investicijske prilike.

Vrijednost investitora neće ulagati u poduzeća koja ne mogu lako razumjeti ili one koje smatraju pretjerano rizičnim.

Većina institucionalnih ulagača, za razliku od vrijednosti investitora, osjećaju primoran da se u potpunosti uloži u svakom trenutku. Oni djeluju kao da sudac zove loptice i štrajkovi-uglavnom štrajkovi-time prisiljavajući ih da ljuljačka na gotovo svakom terenu i odreći se takta selektivnosti za frekvenciju.

Mnogi pojedinačni investitori, kao amaterski igrači, jednostavno ne mogu razlikovati dobar teren od divlje jedan. Both undiscriminating individuals and constrained institutional investors can take solace from knowing that most market participants feel compelled to swing just as frequently as they do.

For a value investor a pitch must not only be in the strike zone, it must be in his “sweet spot.” Results will be best when the investor is not pressured to invest prematurely. There may be times when the investor does not lift the bat from his shoulder; the cheapest security in an overvalued market may still be overvalued. You wouldn’t want to settle for an investment offering a safe 10 percent return if you thought it very likely that another offering an equally safe 15 percent return would soon materialize.

Sometimes dozens of good pitches are thrown consecutively to a value investor. Na paničnim tržištima, na primjer,, broj nedovoljno cijenjenih vrijednosnih papira, a stupanj podcjenjivanja također raste. Na rastućim tržištima, s druge strane, broj nedovoljno cijenjenih vrijednosnih papira i njihov stupanj smanjenja vrijednosti.

Kada su atraktivne mogućnosti obilne, vrijednost investitori su u mogućnosti prosijati pažljivo kroz sve rasprodaje za one koje smatraju najatraktivnijim. Kada su privlačne mogućnosti oskudne, Međutim, ulagači moraju izlagati veliku samodisciplinu kako bi održali integritet postupka vrednovanja i ograničili plaćenu cijenu. Iznad svega, ulagači uvijek moraju izbjegavati ljuljanje na lošim parcelama.

#19: Složenost vrednovanja poslovanja

Bila bi ozbiljna pogreška misliti da su sve činjenice koje opisuju određeno ulaganje ili bi se mogle znati. Pitanja ne samo da mogu ostati neodgovorena; all the right questions may not even have been asked. Even if the present could somehow be perfectly understood, most investments are dependent on outcomes that cannot be accurately foreseen.

Even if everything could be known about an investment, the complicating reality is that business values are not carved in stone. Investing would be much simpler if business values did remain constant while stock prices revolved predictably around them like the planets around the sun.

If you cannot be certain of value, after all, then how can you be certain that you are buying at a discount? The truth is that you cannot.

#20: Expecting Precision in Valuation

Many investors insist on affixing exact values to their investments, seeking precision in an imprecise world, but business value cannot be precisely determined.

Reported book value, earnings, and cash flow are, after all, only the best guesses of accountants who follow a fairly strict set of standards and practices designed more to achieve conformity than to reflect economic value. Projected results are less precise still. You cannot appraise the value of your home to the nearest thousand dollars. Why would it be any easier to place a value on vast and complex businesses?

Not only is business value imprecisely knowable, it also changes over time, fluctuating with numerous macroeconomic, microeconomic, and market-related factors. So while investors at any given time cannot determine business value with precision, they must nevertheless almost continuously reassess their estimates of value in order to incorporate all known factors that could influence their appraisal.

Any attempt to value businesses with precision will yield values that are precisely inaccurate. The problem is that it is easy to confuse the capability to make precise forecasts with the ability to make accurate ones.

Anyone with a simple, hand-held calculator can perform net present value (NPV) and internal rate of return (IRR) calculations. The advent of the computerized spreadsheet has exacerbated this problem, creating the illusion of extensive and thoughtful analysis, even for the most haphazard of efforts.

Typically, investors place a great deal of importance on the output, even though they pay little attention to the assumptions. “Garbage in, garbage out” is an apt description of the process.

In Security Analysis, Graham and David Dodd discussed the concept of a range of value – “The essential point is that security analysis does not seek to determine exactly what is the intrinsic value of a given security. It needs only to establish that the value is adequate – e.g., to protect a bond or to justify a stock purchase or else that the value is considerably higher or considerably lower than the market price. For such purposes an indefinite and approximate measure of the intrinsic value may be sufficient.”

Doista, Graham frequently performed a calculation known as net working capital per share, a back-of-the- envelope estimate of a company’s liquidation value. His use of this rough approximation was a tacit admission that he was often unable to ascertain a company’s value more precisely.

#21: Why Margin of Safety

Value investing is the discipline of buying securities at a significant discount from their current underlying values and holding them until more of their value is realized. The element of the bargain is the key to the process.

Because investing is as much an art as a science, investors need a margin of safety. A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world.

According to Graham, “The margin of safety is always dependent on the price paid. For any security, it will be large at one price, small at some higher price, nonexistent at some still higher price.”

Value investors seek a margin of safety, allowing room for imprecision, bad luck, or analytical error in order to avoid sizable losses over time. A margin of safety is necessary because…

• Valuation is an imprecise art

• Future is unpredictable, i

• Investors are human and do make mistakes.

#22: How Much Margin of Safety

The answer can vary from one investor to the next. How much bad luck are you willing and able to tolerate? How much volatility in business values can you absorb? What is your tolerance for error? It comes down to how much you can afford to lose.

Most investors do not seek a margin of safety in their holdings. Institutional investors who buy stocks as pieces of paper to be traded and who remain fully invested at all times fail to achieve a margin of safety. Greedy individual investors who follow market trends and fads are in the same boat.

The only margin investors who purchase Wall Street underwritings or financial-market innovations usually experience is a margin of peril.

How can investors be certain of achieving a margin of safety?

• By always buying at a significant discount to underlying business value and giving preference to tangible assets over intangibles. (This does not mean that there are not excellent investment opportunities in businesses with valuable intangible assets.)

• By replacing current holdings as better bargains come along.

• By selling when the market price of any investment comes to reflect its underlying value and by holding cash, if necessary, until other attractive investments become available.

Investors should pay attention not only to whether but also to why current holdings are undervalued.

It is critical to know why you have made an investment and to sell when the reason for owning it no longer applies. Look for investments with catalysts that may assist directly in the realization of underlying value.

Give preference to companies having good managements with a personal financial stake in the business. Finally, diversify your holdings and hedge when it is financially attractive to do so.

#23: Three Elements of Value Investing

1. Bottom-Up: Value investing employs a bottom-up strategy by which individual investment opportunities are identified one at a time through fundamental analysis. Value investors search for bargains security by security, analyzing each situation on its own merits.

The entire strategy can be concisely described as “buy a bargain and wait.” Investors must learn to assess value in order to know a bargain when they see one.

Then they must exhibit the patience and discipline to wait until a bargain emerges from their searches and buy it, regardless of the prevailing direction of the market or their own views about the economy at large.

2. Absolute-Performance Orientation: Most institutional and many individual investors have adopted a relative-performance orientation. They invest with the goal of outperforming either the market, other investors, or both and are apparently indifferent as to whether the results achieved represent an absolute gain or loss.

Good relative performance, especially short-term relative performance, is commonly sought either by imitating what others are doing or by attempting to outguess what others will do.

Value investors, s druge strane, are absolute-performance oriented; they are interested in returns only insofar as they relate to the achievement of their own investment goals, not how they compare with the way the overall

market or other investors are faring. Good absolute performance is obtained by purchasing undervalued securities while selling holdings that become more fully valued. For most investors absolute returns are the only ones that really matter; you cannot, after all, spend relative performance.

Absolute-performance-oriented investors usually take a longer-term perspective than relative-performance- oriented investors. A relative-performance-oriented investor is generally unwilling or unable to tolerate long periods of underperformance and there- fore invests in whatever is currently popular. To do otherwise would jeopardize near-term results.

Relative-performance-oriented investors may actually shun situations that clearly offer attractive absolute returns over the long run if making them would risk near-term underperformance. By contrast, absolute- performance- oriented investors are likely to prefer out-of-favor holdings that may take longer to come to fruition but also carry less risk of loss.

3. Risk and Return: While most other investors are preoccupied with how much money they can make and not at all with how much they may lose, value investors focus on risk as well as return.

Risk is a perception in each investor’s mind that results from analysis of the probability and amount of potential loss from an investment. If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky.

But if the well is a gusher, the bond matures on schedule, and the stock rallies strongly, can we say they weren’t risky when the investment was made? Not at all.

The point is, in most cases no more is known about the risk of an investment after it is concluded than was known when it was made.

There are only a few things investors can do to counteract risk: diversify adequately, hedge when appropriate, and invest with a margin of safety. It is precisely because we do not and cannot know all the risks of an investment that we strive to invest at a discount. The bargain element helps to provide a cushion for when things go wrong.

#24: Overpaying for Growth

There are many investors who make decisions solely on the basis of their own forecasts of future growth. After all, the faster the earnings or cash flow of a business is growing, the greater that business’s present value. Yet several difficulties confront growth-oriented investors.

Prvi, such investors frequently demonstrate higher confidence in their ability to predict the future than is warranted. Drugi, for fast-growing businesses even small differences in one’s estimate of annual growth rates can have a tremendous impact on valuation.

Moreover, with so many investors attempting to buy stock in growth companies, the prices of the consensus choices may reach levels unsupported by fundamentals.

Since entry to the “Business Hall of Fame” is frequently through a revolving door, investors may at times be lured into making overly optimistic projections based on temporarily robust results, thereby causing them to overpay for mediocre businesses.

Another difficulty with investing based on growth is that while investors tend to oversimplify growth into a single number, growth is, in fact, comprised of numerous moving parts which vary in their predictability. For any particular business, na primjer,, earnings growth can stem from increased unit sales related to predictable

increases in the general population, to increased usage of a product by consumers, to increased market share, to greater penetration of a product into the population, or to price increases.

Warren Buffett has said, “For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”

#25: Shenanigans of Growth

Investors are often overly optimistic in their assessment of the future. A good example of this is the common response to corporate write-offs.

This accounting practice enables a company at its sole discretion to clean house, instantaneously rid- ding itself of underperforming assets, uncollectible receivables, bad loans, and the costs incurred in any corporate restructuring accompanying the write-off.

Typically such moves are enthusiastically greeted by Wall Street analysts and investors alike; post-write-off the company generally reports a higher return on equity and better profit margins. Such improved results are then projected into the future, justifying a higher stock market valuation. Investors, Međutim, should not so generously allow the slate to be wiped clean.

When historical mistakes are erased, it is too easy to view the past as error free. It is then only a small additional step to project this error-free past forward into the future, making the improbable forecast that no currently profitable operation will go sour and that no poor investments will ever again be made.

#26: Conservatism and Growth Investing

How do value investors deal with the analytical necessity to predict the unpredictable?

The only answer is conservatism. Since all projections are subject to error, optimistic ones tend to place investors on a precarious limb. Virtually everything must go right, or losses may be sustained.

Conservative forecasts can be more easily met or even exceeded. Investors are well advised to make only conservative projections and then invest only at a substantial discount from the valuations derived therefrom.

#27: How Much Research and Analysis Are Sufficient?

Some investors insist on trying to obtain perfect knowledge about their impending investments, researching companies until they think they know everything there is to know about them. They study the industry and the competition, contact former employees, industry consultants, and analysts, and become personally acquainted with top management. They analyze financial statements for the past decade and stock price trends for even longer.

This diligence is admirable, but it has two shortcomings. Prvi, no matter how much research is performed, some information always remains elusive; investors have to learn to live with less than complete information. Drugi, even if an investor could know all the facts about an investment, he or she would not necessarily profit.

This is not to say that fundamental analysis is not useful. It certainly is.

But information generally follows the well-known 80/20 rule: the first 80 percent of the available information is gathered in the first 20 percent of the time spent. The value of in-depth fundamental analysis is subject to diminishing marginal returns.

Most investors strive fruitlessly for certainty and precision, avoiding situations in which information is difficult to obtain. Yet high uncertainty is frequently accompanied by low prices. By the time the uncertainty is resolved, prices are likely to have risen.

Investors frequently benefit from making investment decisions with less than perfect knowledge and are well rewarded for bearing the risk of uncertainty.

The time other investors spend delving into the last unanswered detail may cost them the chance to buy in at prices so low that they offer a margin of safety despite the incomplete information.

#28: Value Investing and Contrarian Thinking

Value investing by its very nature is contrarian. Out-of-favor securities may be undervalued; popular securities almost never are. What the herd is buying is, by definition, in favor. Securities in favor have already been bid up in price on the basis of optimistic expectations and are unlikely to represent good value that has been overlooked.

If value is not likely to exist in what the herd is buying, where may it exist? In what they are selling, unaware of, or ignoring. When the herd is selling a security, the market price may fall well beyond reason. Ignored, obscure, or newly created securities may similarly be or become undervalued.

Investors may find it difficult to act as contrarians for they can never be certain whether or when they will be proven correct. Since they are acting against the crowd, contrarians are almost always initially wrong and likely for a time to suffer paper losses. By contrast, members of the herd are nearly always right for a period. Not only are contrarians initially wrong, they may be wrong more often and for longer periods than others because market trends can continue long past any limits warranted by underlying value.

Holding a contrary opinion is not always useful to investors, Međutim. When widely held opinions have no influence on the issue at hand, nothing is gained by swimming against the tide. It is always the consensus that the sun will rise tomorrow, but this view does not influence the outcome.

#29: Fallacy of Indexing

To value investors the concept of indexing is at best silly and at worst quite hazardous.

Warren Buffett has observed that “in any sort of a contest — financial, mental or physical — it’s an enormous advantage to have opponents who have been taught that it’s useless to even try.” I believe that over time value investors will outperform the market and that choosing to match it is both lazy and shortsighted.

Indexing is a dangerously flawed strategy for several reasons. Prvi, it becomes self-defeating when more and more investors adopt it.

Although indexing is predicated on efficient markets, the higher the percentage of all investors who index, the more inefficient the markets become as fewer and fewer investors would be performing research and fundamental analysis.

Doista, at the extreme, if everyone practiced indexing, stock prices would never change relative to each other because no one would be left to move them.

Another problem arises when one or more index stocks must be replaced; this occurs when a member of an index goes bankrupt or is acquired in a takeover.

Because indexers want to be fully invested in the securities that comprise the index at all times in order to match the performance of the index, the security that is added to the index as a replacement must immediately be purchased by hundreds or perhaps thousands of portfolio managers.

Owing to limited liquidity, on the day that a new stock is added to an index, it often jumps appreciably in price as indexers rush to buy. Nothing fundamental has changed; nothing makes that stock worth more today than yesterday. In effect, people are willing to pay more for that stock just because it has become part of an index.

I believe that indexing will turn out to be just another Wall Street fad. When it passes, the prices of securities included in popular indexes will almost certainly decline relative to those that have been excluded.

More significantly, as Barron’s has pointed out, “A self-reinforcing feedback loop has been created, where the success of indexing has bolstered the performance of the index itself, which, in turn promotes more indexing.”

When the market trend reverses, matching the market will not seem so attractive, the selling will then adversely affect the performance of the indexers and further exacerbate the rush for the exits.

#30: It’s a Dangerous Place

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard.

The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. Ovo treba priznati, prihvatio, i bavila. Ako te obavljati poslove s Wall Streeta s tim u vidu upozorenja, možete napredovati.

Ako ti ovisi na Wall Streetu će vam pomoći da, ulaganja uspjeh može ostati nedostižan.

—————————————————————————————

Također možete ih poslati na sljedeći link gdje mogu prijaviti za Safal Niveshak Post sebe i dobiti ovaj posebno izvješće za besplatno-http://eepurl.com/cYgak

Dodati u favorite

Dodati u favorite